Today, the federal government provides about 9 percent of the funding for K-12 public schools. The Center for American Progress (CAP) has just issued a call for raising that amount to more like 11 percent, putting the extra money into high-poverty schools in a way that doesn’t otherwise increase federal control of how states and school districts manage public education. The CAP proposal, under the title “How to Give Teachers a $10,000 Raise,” would provide federal tax credits directly to teachers who work in high-poverty schools.

Here we offer: (1) a quick review of how the idea would work; (2) an explanation of why this appears to be a way to tackle a big obstacle to ensuring that teacher talent is equitably distributed; (3) an argument as to why this might actually be politically feasible; and (4) a small, technical gotcha that needs a little attention.

The idea is simple. If a teacher signs on to a school with 75 percent or more of students on free or reduced-price lunch (FRPL), then the teacher gets a $10,000 refundable credit on her income taxes come April 15. The refundable credit part is important, because it means the teacher gets the money back no matter what else is going on with her tax return. Teachers who work in less poor schools, but still poor (>50 percent), would qualify for a reduced credit.

All told, about 57 percent of the teachers in the U.S. would be eligible for some level of substantial tax credit.

The proposed tax credit does two things: First, it would likely increase the available supply of teachers who want to work in high-poverty schools, achieving greater equity and improved education. There is a well-documented gap in average teacher quality between low-poverty and high-poverty schools (see here and here). Second, it also would provide a tax credit for teachers who are already there. That’s only fair. Teaching in high-poverty schools is an awfully tough job. CAP’s policy seeks to close what it observes as an existing $4,000 pay gap between teachers in the highest-poverty and the lowest-poverty schools, although part of that gap is due to a higher proportion of high-poverty schools being located in low-income areas (where all salaries are lower), and part is due to teachers in high-poverty schools having less experience and therefore sitting at a lower line on the salary scale.

A $10,000 tax credit is equivalent to just under a 20 percent raise for a teacher at the national average. In low-income states and in low-income districts, because teacher salaries are low, the raise is likely to be more than 20 percent. Analogously, the percentage increase may be less in low-income urban schools that are located in school districts that pay above the national average.

There is, however, at least a question as to whether a tax credit is as salient to teachers as a direct salary increase. We know from different studies that pension enhancements are less attractive to teachers than are equivalent increases in salary. However, a tax credit is much closer to a current salary boost than the promise of a better pension many years in the future. Still, it might make sense for districts to emphasize that eligible teachers can reduce their tax withholding in order to get an immediate increase in take-home pay.

Enticing strong teachers to move to disadvantaged schools won’t be a panacea for all the education problems associated with poverty: The teacher quality gap is significant, but it is not always as huge as some believe.

Still, jobs that pay more tend to be more competitive, drawing more applicants. Even a healthy-sized tax credit does not mean that all teachers will gravitate toward these opportunities. But unless teaching is exempt from basic labor economics, more teachers will almost certainly apply than would otherwise. It’s worth noting that district experience with such enticements have been mixed—with some succeeding better than others at convincing teachers from less challenging jobs to more challenging ones—but we’re also not aware of any other effort where the salary increase was both large and permanent.

This targeted tax credit also manages to walk a fine line between those who advocate paying some teachers higher salaries with those who advocate that an across the board raise is what is needed. The CAP proposal would apply only to teachers who are making a very specific extra contribution by working in high-poverty schools. While performance isn’t ostensibly a factor, we presume competition for these higher paying positions would allow principals in these schools to become a lot more selective about whom they hire, as well as reducing expensive teacher turnover and reliance on long-term substitutes or out-of-field teachers. (A North Carolina study by Charles Clotfelter and co-authors found that an $1,800 annual bonus lowered turnover rates by 17 percent.) That suggests that districts might do well to review their hiring systems in the face of a changed landscape.

Another reason the proposal makes sense is that tax credits are “off-budget” in the same way that the deductibility of mortgage interest is. That means that Congress doesn’t have to re-fight about the topic each year (and even avoids fickle state legislatures and school district budgets which can go from riches to rags overnight). Congress can make changes—as they have recently with the deductibility of mortgage interest—but once in place refundable credits are likely to be stable for a number of years. Stability is important for teachers making long-term career choices.

What’s more: $10,000 is actually worth more than $10,000. That’s because a tax credit is after-tax income. A typical teacher is likely in the 22 percent tax bracket on her federal return (a bit higher in states with a state income tax). In order to take home an extra $10,000, that teacher would need to earn $12,505.51 more. So a $10,000 credit actually comes with a $2,500 (plus change) take home bonus.

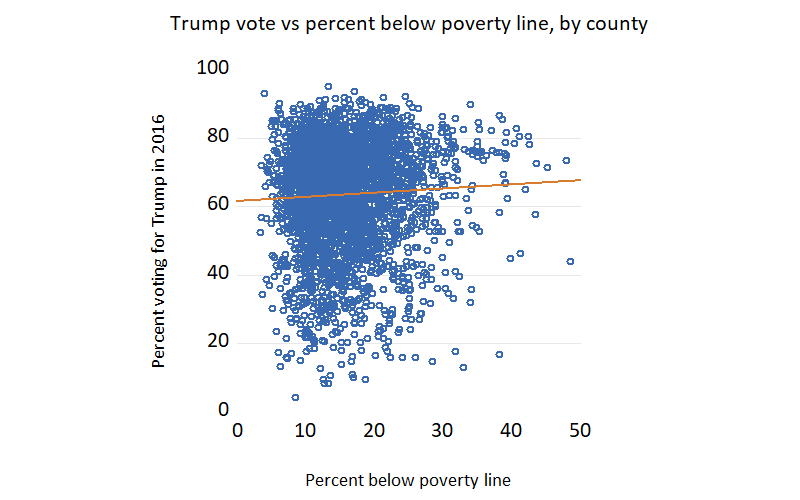

Key to its political viability is the fact that “high poverty” is as helpful to rural areas as urban—maybe more so where $10,000 is a higher percentage increase because salaries and the cost-of-living is low. In fact, high-poverty counties are more likely to have voted for President Trump in the last election than are low-poverty counties. Here’s a little scatterplot. (Note: Vote data is from Tony McGovern; poverty data is from the Census Bureau.)

The correlation between red votes and areas of poverty is not terribly strong (although it is strongly statistically significant), but it’s positive—not negative. In other words, there is a bunch of red state members of Congress who should have a strong interest in funneling money into high-poverty schools. Eventually, such a proposal has to be paid for of course, which should be a concern for everyone. CAP calculates the cost of the program to be about one-tenth the size of the recently passed federal tax cuts.

Now to that small, technical gotcha. Looking at FRPL is not such a good measure of poverty, in part because a number of districts now provide free lunches to all students, in response to an anachronistic system which is dependent upon families submitting a form declaring themselves to be poor. (See Brookings-based discussions here and here and here.) Fortunately, a better measure would be simple to implement. Eligibility for FRPL corresponds roughly to income below 185 percent of the poverty line. So change the credit-eligibility criteria from FRPL to a set fraction of students below the poverty line equivalent. You don’t need to know the income of individual families. If you know where your students live, then a poverty measure can easily be put together from Census data. Using such poverty data directly really gets right to the heart of where teachers should be getting an extra (tax) credit.

The high-poverty-school-refundable-tax-credit idea is a good idea that should have wide appeal, if ideas were still judged on their merits. While CAP is a left-of-center organization, we’ve pointed out why the idea should appeal to both sides of the aisle. Given the income distribution across the country, much benefit would end up in low-income and rural states that are often conservative strongholds. And using tax cuts rather than policy mandates ought to appeal to the conservative agenda. Bipartisanship may be a quaint notion in the current political context, but this is an idea well worth consideration from all sides.

Commentary

Tax credits can help high-poverty schools attract more teachers

July 30, 2018